The development of the organic sector in 2021 - BIOFACH and partners take stock

- BiO ReporterIn

- Feb 16, 2022

- 5 min read

Biofach has been postponed to the summer at the request of many exhibitors, but the latest industry figures were presented online on the original February date of the organic industry meeting. Danila Brunner, head of the Biofach and Vivaness trade fair duo, was pleased about the very lively interest in the facts and figures on the sector. She summed up the general trend of development nationally and internationally with the words: "Organic is developing positively-dynamically, but also faces challenges. We are experiencing a great transformation." Diana Schaak, Market Analyst, Agrarmarkt Informations-Gesellschaft, AMI, Tina Andres, Chairwoman of the Board, BÖLW (Bund Ökologische Lebensmittelwirtschaft) and Klaus Braun, Founder, Klaus Braun Kommunikationsberatung, went into detail about the German organic market, presenting facts and figures and analysing them.

AMI figures and analysis: Grocery trade large-scale wins, NEH loses

Diana Schaak, AMI, gave an overview of the development of the overall market with a comparison between organic and conventional sales channels. As expected, the sales explosion from the first Corona year of over 22 % sales growth for organic products across all sales channels could not be maintained. Nevertheless, organic sales increased by 5.8 % to 15.87 billion euros in 2021. The figures determined by the Arbeitskreis Biomarkt show that above all food retailers, including drugstores, benefited strongly from consumer spending on organic products and achieved the greatest growth of 9.1 % to 9.88 billion euros. In second place, with 7.4% growth, bakeries, butchers, weekly markets, farm shops, health food shops etc expanded their share of sales to 2.41 billion euros of the total market, while the specialist health food trade had to accept a decline in sales of 3.3% to 3.58 billion euros for the first time.

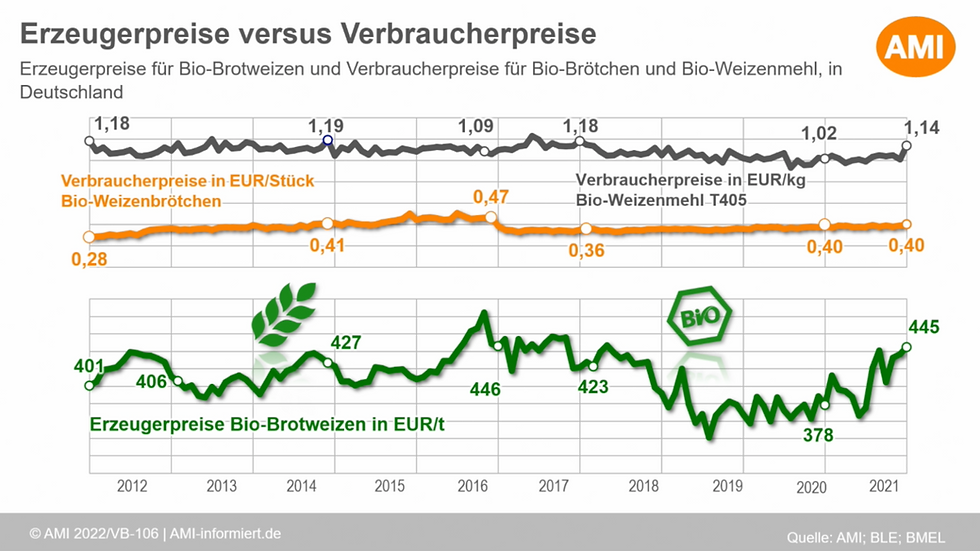

In addition to the turnover figures, Diana Schaak addressed the precarious situation of producers. The conversion wave has flattened out - only 320 new organic farms and just under 82,000 ha of organic land were added in 2021: demand exceeds supply in several product groups. In addition, prices for inputs, energy and transport are rising, while retailers are not yet reacting to the increases in production costs with price increases.

Organic share continues to grow in the product groups

It is clear that the organic share in many product groups is still not increasing significantly. However, the categories of plant-based milk alternatives and meat substitutes clearly stand out with growth of over 60 % each. Here too, however, large scale retail is in the lead.

It is worth noting that younger people in particular - families with children, young singles and couples without children - are increasingly turning to organic plant-based alternatives. Overall, however, organic consumption cuts across all age groups, according to the GfK household panel from 2020.

The BÖLW also summarises the top sellers: Demand for organic meat, milk alternatives and butter increased in 2021 with sales growth rates between 14.6 % and 27 %. The organic share of the total market reached 62.4 % for plant-based drinks, 26.6 % for meat substitutes, eggs rose to almost 17 %, flour to over 15 %. According to the preliminary calculations, the organic share of the German food market increased to 6.8 %.

"Business as usual" is not a viable concept for success in the organic food trade!

Klaus Braun, expert for the specialized organic food retail, had clear words to say about the development and backed them up with figures. Of the almost 200 euros per capita spent on organic food in Germany, only about 43 euros end up in the natural food retail trade, and the share of turnover in the total market has been shrinking for many years. He emphasised that the share of organic food in the total market had fallen from over 40% to 23%, with a drop in turnover of 3.3% in 2021. He called on the specialised trade industry to develop forward-looking strategies and new unique selling propositions to end this trend.

As reasons for this development, Klaus Braun pointed out that the natural food trade is increasingly losing its unique selling proposition of "selling organic". More and more companies outside the specialised trade are taking up this trend, and the competition from organic product ranges and organic trade brands in food retailing and discounters is increasing. In addition, there are challenges in marketing (influencers/online marketing/Facebook, etc.).

The BNN (Bundesverband Naturkost Naturwaren), the association representing organic food retailers, sees things somewhat differently: In a press release, the association was quite satisfied with the development and calculated a turnover of 4.21 billion euros in organic specialised retail. Despite a decline of 3.7 % compared to the previous year, the turnover is still about 12 % above the pre-Corona year 2019 (3.76 billion euros). In a three-year comparison, the organic specialist trade has grown by an average of 7 % annually since 2019.

BNN Executive Director Kathrin Jäckel would like to see more support from the political side for the organic sector, which with its diversity in processing and trade, its smaller and artisanal structures could offer a real consumer alternative to conventional large-scale structures. "The pandemic has shown in many areas how fragile global supply chains are. For supply security and the strengthening of rural regions, organic, which comes from diverse, decentralised and resilient structures, should continue to grow above all. This requires policy measures that promote the production, processing and sale of healthy, affordable and sustainable organic food not only in its breadth, but also in its diversity and quality"

BÖLW: "Strong policies are now finally needed for 30% organic by 2030"

"Society is ready for a sustainable transformation and so is the organic sector. We can change the world with food", said Tina Andres, Chair of the Board of the German Organic Food Association (BÖLW) at the BioFach press conference. More customers would also buy more organic in 2021. More farmers, more food producers and traders were opting for organic. "Although the politics of the last few years have been quite hostile to organic," she said and added: "It is now up to those in power, above all Federal Minister Cem Özdemir, not only to proclaim 30% organic by 2030 and organic as the guiding principle, but to set all the necessary course for the restructuring of our agricultural and food system. Organic is the heart of this transformation. Because organic farms become future-proof. Value chains become more resilient. Moreover, with organic food in the shopping basket, people eat healthier, GMO-free and more climate-friendly food - whether at home or in day-care centres, schools or canteens," says Andres.

She emphasised: "The food revolution must now follow the energy revolution. Organic farming offers a system that already works economically and ecologically on thousands of farms, a control system and labelling that includes all foods from apples to bread to sausages. "The 30% organic target by 2030 is achievable. We need to get started now and thus also set the greening of the remaining 70 % on the right track!" she appealed to politicians to set the course accordingly. The transformation costs money, but not doing it costs even more, in the worst case, the future of the next generations.

Images and charts are screenshots from the BioFach / Vivaness online event.

Karin Heinze, BiO Reporter International

Comments